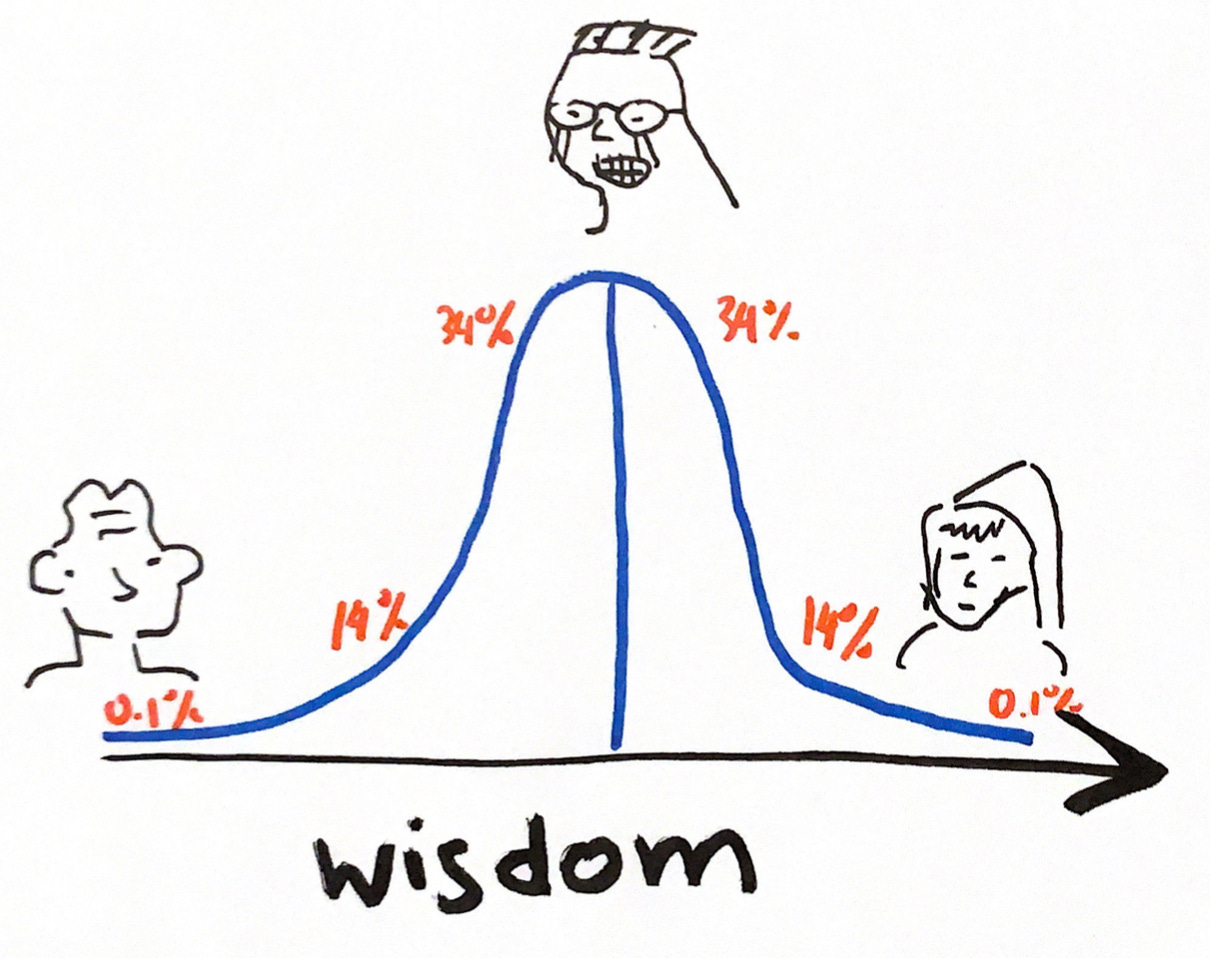

Exploring the Midwit Meme: Traits Shared by Geniuses and "Retards"

If you are part of the online right-wing movement, chances are that you've come across the midwit meme. Graphically presented by a bell curve divided into three quadrants - the midwit quadrant (average IQ), the retard quadrant (low IQ), and the genius quadrant (high IQ). If the meme is used, both the right and left quadrants usually share a statement; however, the right one formulates it with profound mannerisms, while the left does not.

It is used to demonstrate the two types of right wingers and there are studies suggesting that individuals with autistic traits, correlated with exceptionally high intelligence, are more often right-wingers, while the less intelligent populace is also more likely to lean towards right-wing views. But what causes the similarity among the genius and idiot; what features do the idiots and the geniuses share?

Well, there are a couple of not-so-distinct features that they do, in fact, share. Firstly, the urge to conform is lower on both ends of the spectrum.

Idiots are more often criminal (which still holds true when adjusting for wealth, etc.), and geniuses share a lack of conformity caused by their autistic traits. This is evident when sampling the biggest inventors or scientists.

Another feature both groups share is a lack of signalling ability — maybe also a lack of will to do so caused by the first quality they share. The idiots cannot fool us to believe in their high intellect, while the autistic genius is not able to signal for his lack of social intelligence.

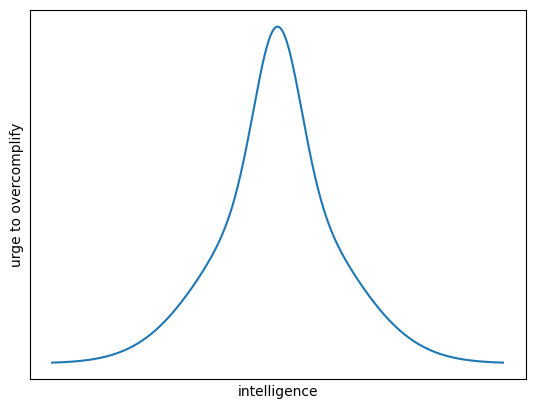

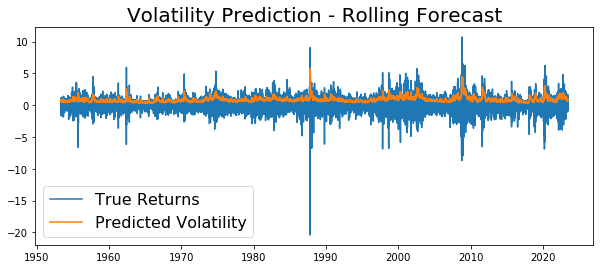

Such an urge to signal intelligence most likely causes an urge to overcomplify. This urge to complify is most prevalent in the academic sector. An example for such an academic overcomplification would be the GARCH models. GARCH is acronym for Generalized Autoregressive Conditional Heteroscadacity. The model won the nobel prize (a model itself cannot win the nobel prize but you get the point) an improvement the EGARCH model parameters (1,1) predicted vola for the S&P 500 (*1885-2022) is shown below.

Now let us take look at the traders model. The 200 Day SMA is used to time buying and selling of securities. When the security is above its 200 Day average buying is advised and when it is below selling. If we look at the volatility of the S&P 500 and exclude periods where the heuristic advises to sell, we see that the rule accurately predicts volatility spikes. The main objective of the GARCH models predicting spikes can be achieved to a higher degree by using the 200 Day SMA heuristic.

The tendency to overcomplicate is very common in papers, where complex notation is employed even for the simplest of assumptions.

*Before 1987 calculations and predecessors to the S&P 500 were used

Conclusion:

The midwit meme highlights the interesting features shared by the lower end of the IQ distribution and its counterpart. In many cases both groups share the same view as both do not overcomplify or care about societal consequences in comparison to the „midwit“. Overcomplification is commonplace in academics and should be avoided at all cost.